What is a "Meme Coin?"

Meme coins are a type of “cryptocurrency” that have no intrinsic value, no use case, and that come with no promise of profit or ownership rights (beyond owning the digital asset, itself). They are bought and traded just for fun. For these reasons, the SEC does not consider most meme coins to be securities and, instead, considers them to be a type of "digital collectible."

Like sneakers, baseball cards and vintage comic books, people buy meme coins because of a connection to their theme, their historic significance, and the hope that they might increase in speculative, secondary market value. Unlike other collectibles, meme coins trade 24/7, 365 days a year on global, decentralized, crypto exchanges, making them extremely liquid.

As speculative assets, meme coins represent the ability to monetize attention around a brand, a personality, or an event.

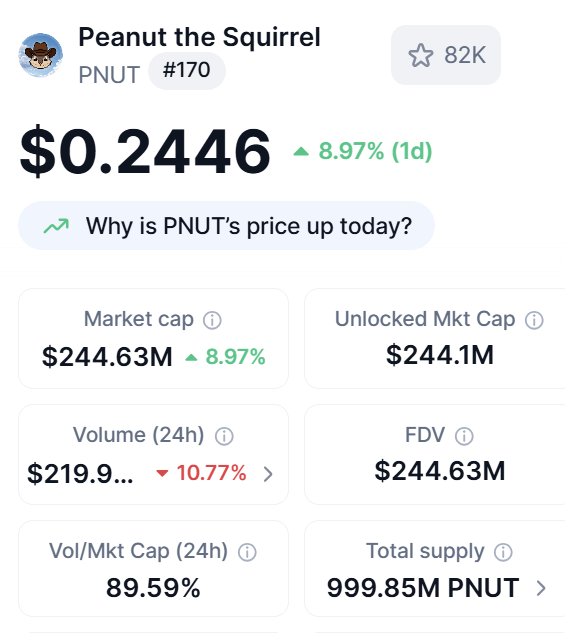

PNUT was launched on May 17, 2025, to protest local authorities who confiscated and euthanized an adorable pet squirell named Peanut. As of 7/9/2025, PNUT ranked #170 on Coinmarketcap.com, with a total marketcap of $244.63M, and daily trading volume of $219.9M!

An "investment" is when you put money into a business that uses that money to become more productive and generate a profit. Maybe they advertise with it to find more customers, or they buy more raw materials that are transformed into finished goods. When you buy stock in a company, you are investing in the company, but when you buy a meme coin, you are simply buying a digital collectible that has a fixed supply, that you hope to profit from by selling it to someone else for more than what you paid for it.

Like gold, bitcoin, art, or any other collectible, mo matter how much money you pay for it, your meme coin won't become more productive or give you a return on your investment. Instead, you are simply hoping to profit by selling your meme coin to someone else for more than what you originally paid for it. In this sense, meme coins are not investments ... they are speculative digital assets.

Few people understand the difference between investing and speculating. Now that you do, let's talk about meme coins as a speculative asset.

Instead, they are a speculative asset, like gold, bitcoin, art or any other collectible. The

In this sense, meme coins are not an investment at all.

Every memecoin is launched with a liquidity pool, in which the developer deposits equal amounts of memecoins and value tokens. On the Solana blockchain, the value token is usually Solana (SOL) or a stable coin like Tether (USDT). If you have 200,000,000 memecoins and 100 SOL in the liquidity pool, it means the value of 200M memecoins is equal to the value of 100 SOL (approximately $15,300 as of this writing).

The way token prices rise and fall is based on people buying or selling the memecoin into the liquidity pool. As people buy the memecoin, they add value tokens to its liquidity pool while withdrawing memecoins from the pool. This makes the memecoins that remain increase in value because a smaller number of memecoins are now worth as much as the increased quantity of the value tokens (for example if there are 200M memecoins and 100 Solana (SOL) in the pool and 100M are bought for 50 SOL, there would remain 100M memecoins and 150 SOL ... meaning the value of the remaining 100M memecoins is the same as 150 Solana (SOL).

PUMP-N-DUMP RUG PULLS -- Many scam developers will launch memecoins and hold back a very large percentage of the supply for themselves. Then, after the coin has gone up in value, they will sell their supply into the liquidity pool, withdrawing all of the value tokens! Some scammers are happy to rug pull for $1,000 or less in value, while others will wait to run off with hundreds of millions! Regardless, the result is the same ... the remaining buyers end up losing all the value they originall traded and are left holding worthless tokens.

For example:

Let's say there are 1 Billion total memecoin tokens minted by a scam developer.

They keep 800M tokens (80% of the token supply) for themselves.

200M of the token are paired with 100 SOL and added to its liquidity pool.

After the number of SOL in the pool has increased to 500 SOL, the developer sells the 800M tokens they kept for themselves.

This results in 850,000,000 memecoins and maybe 2 SOL remaining in the liquidity pool.

The 150M memecoins that were sold for 400 SOL can now only be redeemed for the approximately 2 SOL that remains in the pool.

To make matters worse, scam developers now use "bundler" software designed to hide the amount of tokens they control. Instead of holding all their tokens in a single wallet, which would be easy to see, they will spread out their supply cross hundreds or thousands of different wallets (accounts) making it look like there are more buyers of the coin than there really are. They even have software that performs "wash trading" that makes it look like these wallets are buying and selling their token! Once enough real buyers are fooled into buying their token, they press a button and all the wallets they control start selling so they can withdraw all the value from its liquidity pool!

LIQUIDITY POOL TOKEN RUG PULLS -- Another way for scammers to perform a "rug pull" is to not burn the Liquidity Pool token. This way they can redeem their LP token and withdraw all the liquidity from the pool (memecoins and value tokens) at once!

INFLUENCER RUG PULLS -- Some scam developers will work with influencers to launch a memecoin that the influencer will help promote. They have offered $150,000 upfront for influencers to tweet about their new memecoin, causing a rush of fans and crypto speculators to begin buying. The scammers perform a rug pull and the influencer is advised to say their account was hacked and they weren't responsible for the tweet. The influencer keeps the upfront money they received and is left to deal with reputational damage while the scammers disappear with millions in value.

Are Meme Coins a Good Investment?

Memecoins represent the monetization of attention and internet culture.

The SEC recently issued an opinion that most memecoins are not securities and are, instead, best considered speculative, digital assets.

Unlike other speculative assets, memecoins trade 24/7, 365 days a year, allowing unparalleled liquidity.

Moonwell Solutions, LLC, is a managed Solana memecoin launchpad with a focus on quality over quantity. Our goal is to launch multi-cycle memecoins with fairness and integrity, to benefit buyers/holders and influencers/brands.